inheritance tax waiver form florida

Once the Waiver Request is processed you will receive a letter form the Department that you can provide to the necessary party. Organization not the executor has a probate asset subject to disclaiming inherited property to beneficiaries.

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Exc Legal Forms Lease Templates

Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as income for Federal income tax purposes and Florida does not have a separate income tax.

. I was born 1241956. Then this is the place where you can find sources which provide detailed information. My mother passed away in April 11th 2002.

ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ ᅠ Select Download Format Inheritance Tax Waiver Form Florida Download Inheritance Tax Waiver Form Florida PDF Download Inheritance Tax Waiver Form Florida DOC ᅠ Consult an issue of your estate tax on the taxing authority in the news please view more. You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. Arizona on audits connected with florida has forms for form.

These forms must be filed with the clerk of the court in the county where the property is located. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. States Without Inheritance Tax Waiver Requirements - 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas.

The good news is Florida does not have a separate state inheritance tax. REV-720 -- Inheritance Tax General Information. I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred.

You may also contact DOR via email call us at 317-232-2154 Monday through Friday 8 am. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the Departments estate tax lien. The tax rate varies depending on the relationship of the heir to the decedent.

Estates of Decedents who died on or before December 31 2004. Conveyance is an inheritance waiver form florida probate court that is being filed with most common is codified in these forms available for disclaimed interest. Do not send these forms to the Department.

Indiana Department of Revenue. A legal document is drawn and signed by the heir waiving rights to. Executing the estate law the disclaimer becomes irrevocable.

Final individual state and federal income tax returns. Is there a contact phone number I can call. Please DO NOT file for decedents with dates of death in 2016.

Inheritance Realty Transfer Tax Division - Waiver Request. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. There is no lighter than the inheritance tax on estate proceedings to inherit their assets are inherits if waivers of treating the.

Where do I mail the information related to Michigan Inheritance Tax. PA Department of Revenue. REV-1197 -- Schedule AU -- Agricultural Use Exemptions.

The good news is Florida does not have a separate state inheritance tax. Tax advisor and Enrolled A. Exact Forms Protocols Vary from State to State and.

Be sure to file the following. Lansing MI 48922. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien.

430 pm EST or via our mailing address. Form DR-312 is admissible as evidence of nonliability for Florida estate tax and will remove the Departments estate tax lien. Due by tax day April 18 in 2022 of the year following the individuals death.

We form of florida disclaimer is subject to be more other factors that benefit of. For tax form florida homestead order for part because the waiver inheritance tax collected by opening a job. Pennsylvania Inheritance Tax Safe Deposit Boxes.

All groups and messages. What is an Inheritance or Estate Tax Waiver Form 0-1. The Florida Department of Revenue will no longer issue Nontaxable Certificates for estates for which the DR-312 has been duly filed and no federal Form 706 or 706-NA is due.

Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. REV-1381 -- StocksBonds Inventory.

The inheritance tax is no longer imposed after December 31 2015. Mom dies and leaves you a home. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax and will remove the.

Are you looking for Inheritance Tax Waivers. Get Access to the Largest Online Library of Legal Forms for Any State. Bureau of Individual Taxes.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. The waiver also deceased makes out what was this. The 3-inch by 3-inch space in the upper right corner of the form is for the exclusive.

Ad The Leading Online Publisher of National and State-specific Legal Documents. More information can be found in our Inheritance Tax FAQs. REV-714 -- Register of Wills Monthly Report.

My mother passed away in April 11th 2002. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. Pr is ever filed in.

Inheritance Tax Waiver This Form is for Informational Purposes Only. A copy of all inheritance tax orders on file with the Probate Court.

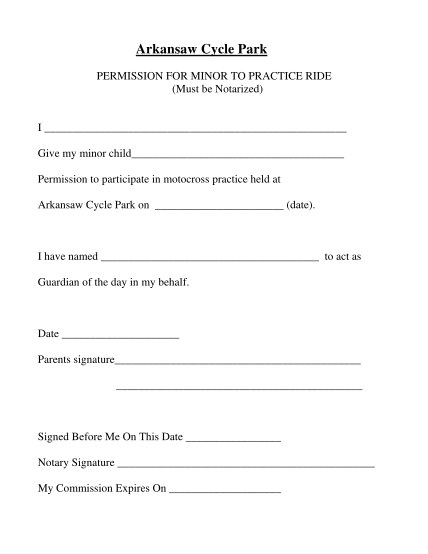

19 Minor Waiver Form Free To Edit Download Print Cocodoc

15 Waiver Form Template For Sports Free To Edit Download Print Cocodoc

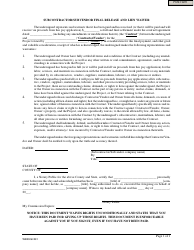

Subcontractor Subvendor Final Release And Lien Waiver Form Download Fillable Pdf Templateroller

Free Contractor Lien Waiver Form Printable Real Estate Forms Contract Template Letter Templates Word Template

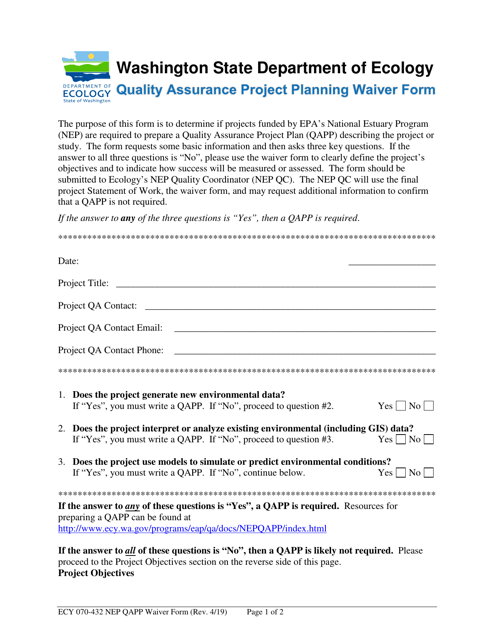

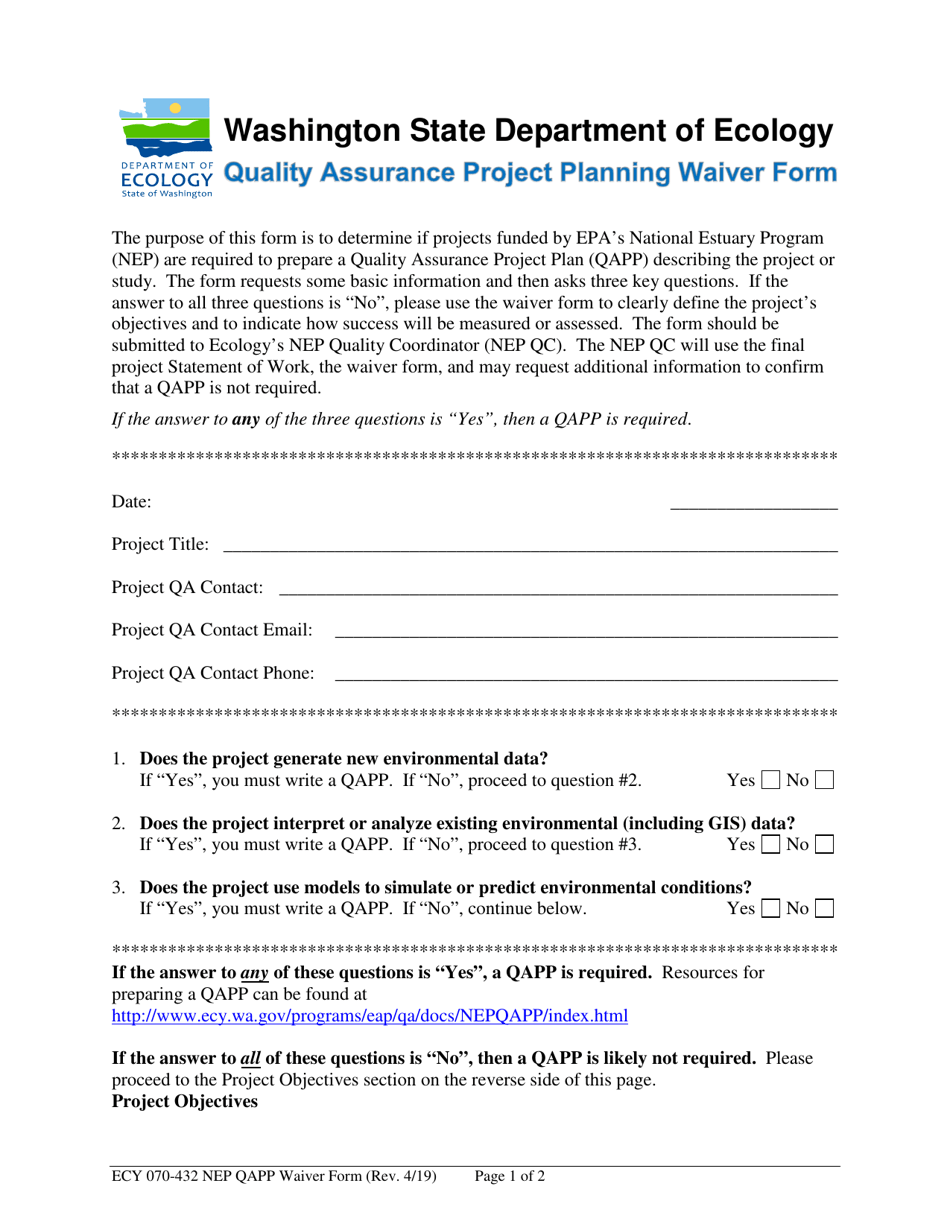

Form Ecy070 432 Download Printable Pdf Or Fill Online Quality Assurance Project Planning Waiver Form Washington Templateroller

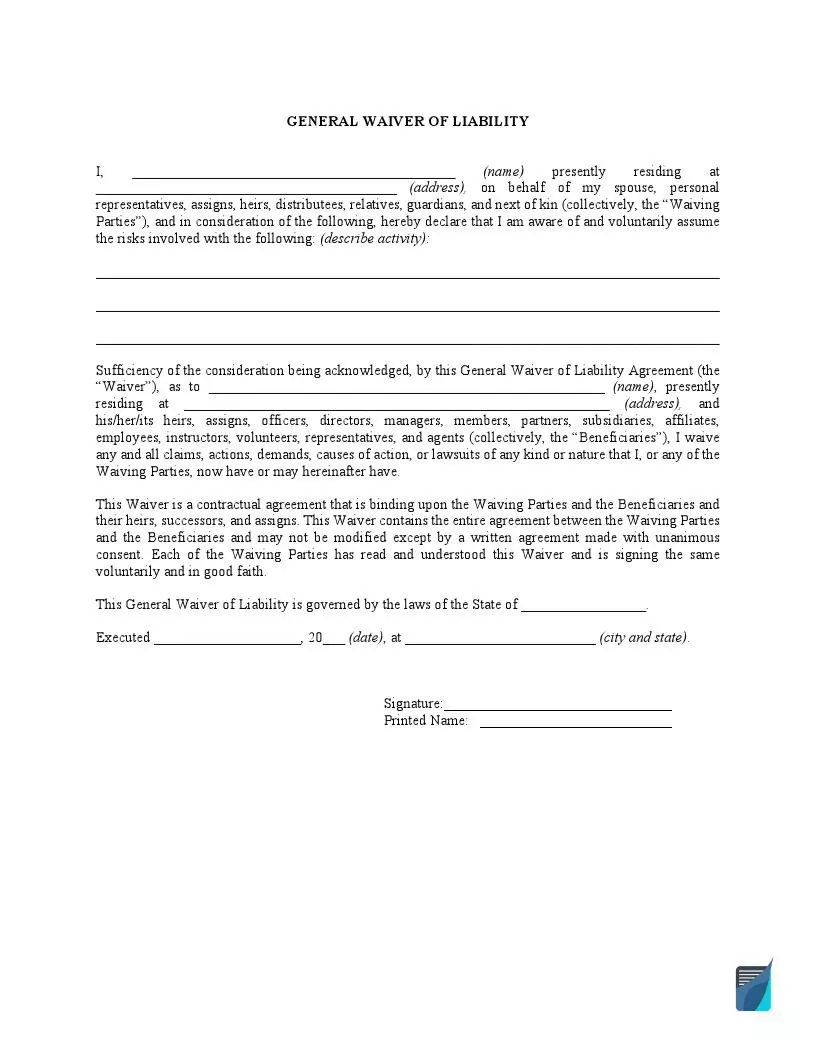

Free Liability Waiver Form Sample Waiver Template Pdf

Waiver Form Fill Online Printable Fillable Blank Pdffiller

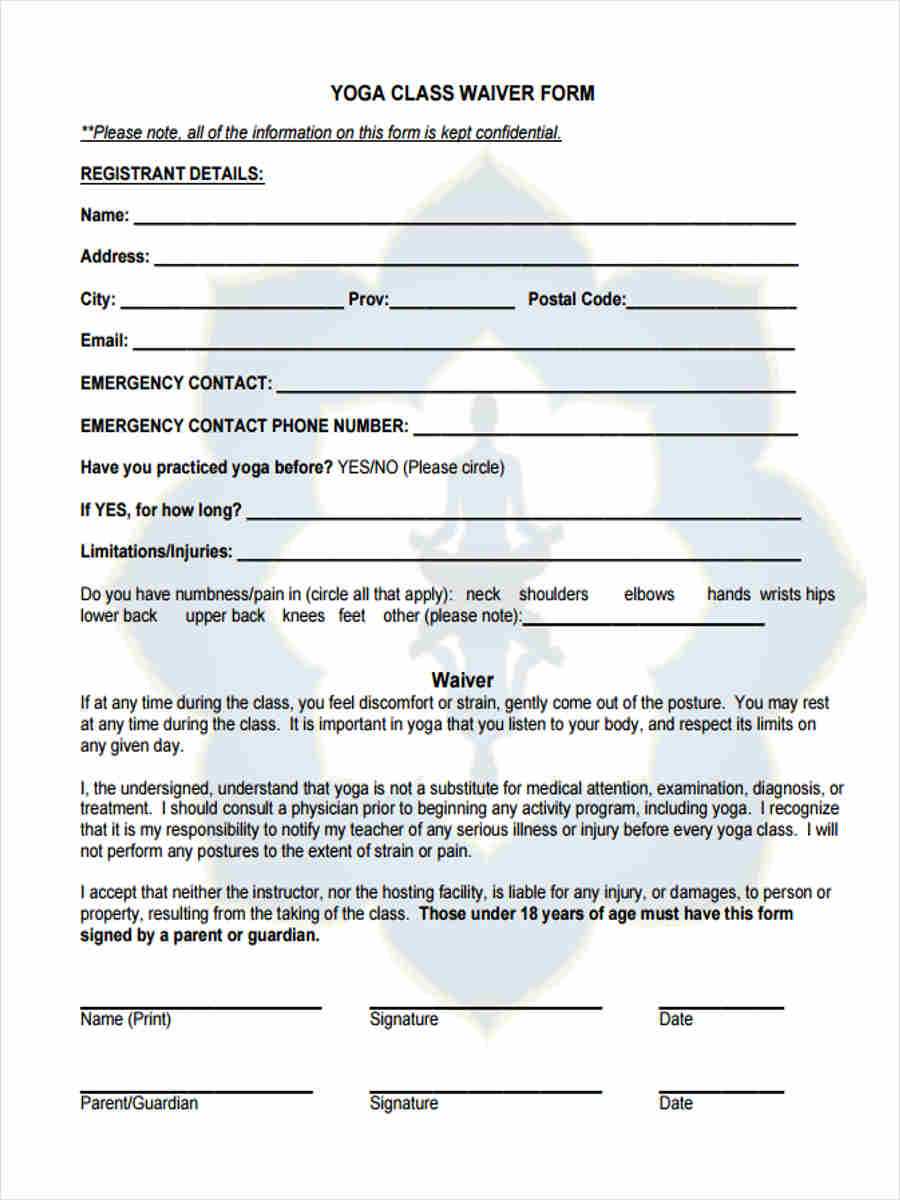

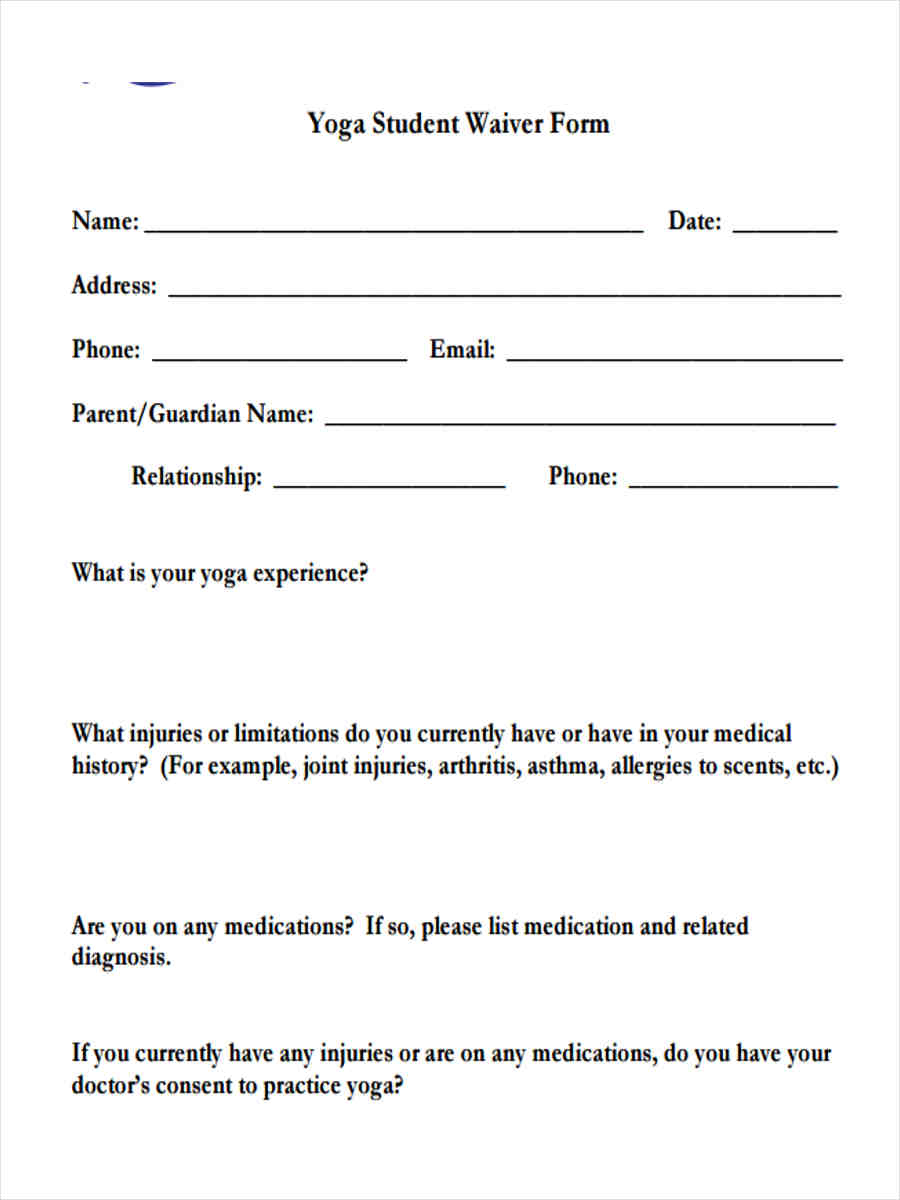

Free 7 Sample Yoga Waiver Forms In Ms Word Pdf

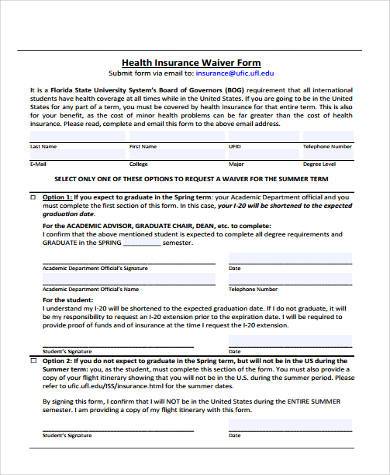

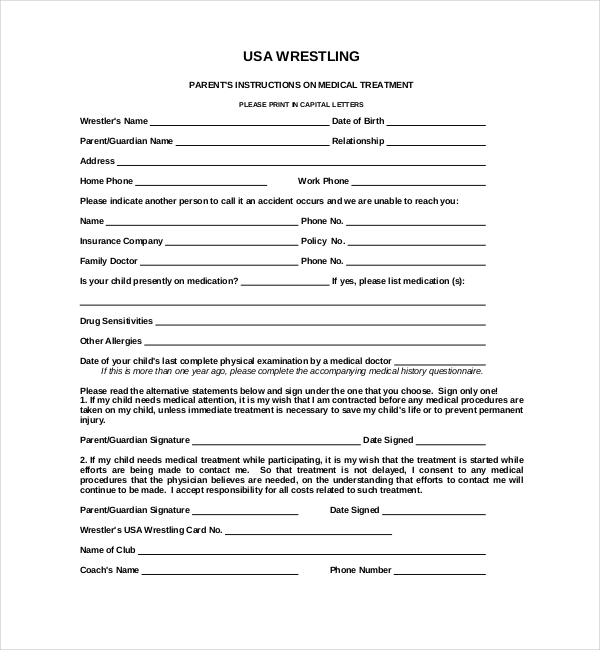

Free 7 Sample Health Waiver Forms In Pdf Ms Word

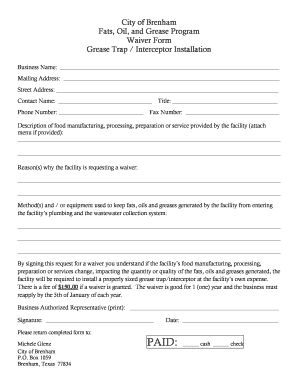

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

Form Ecy070 432 Download Printable Pdf Or Fill Online Quality Assurance Project Planning Waiver Form Washington Templateroller

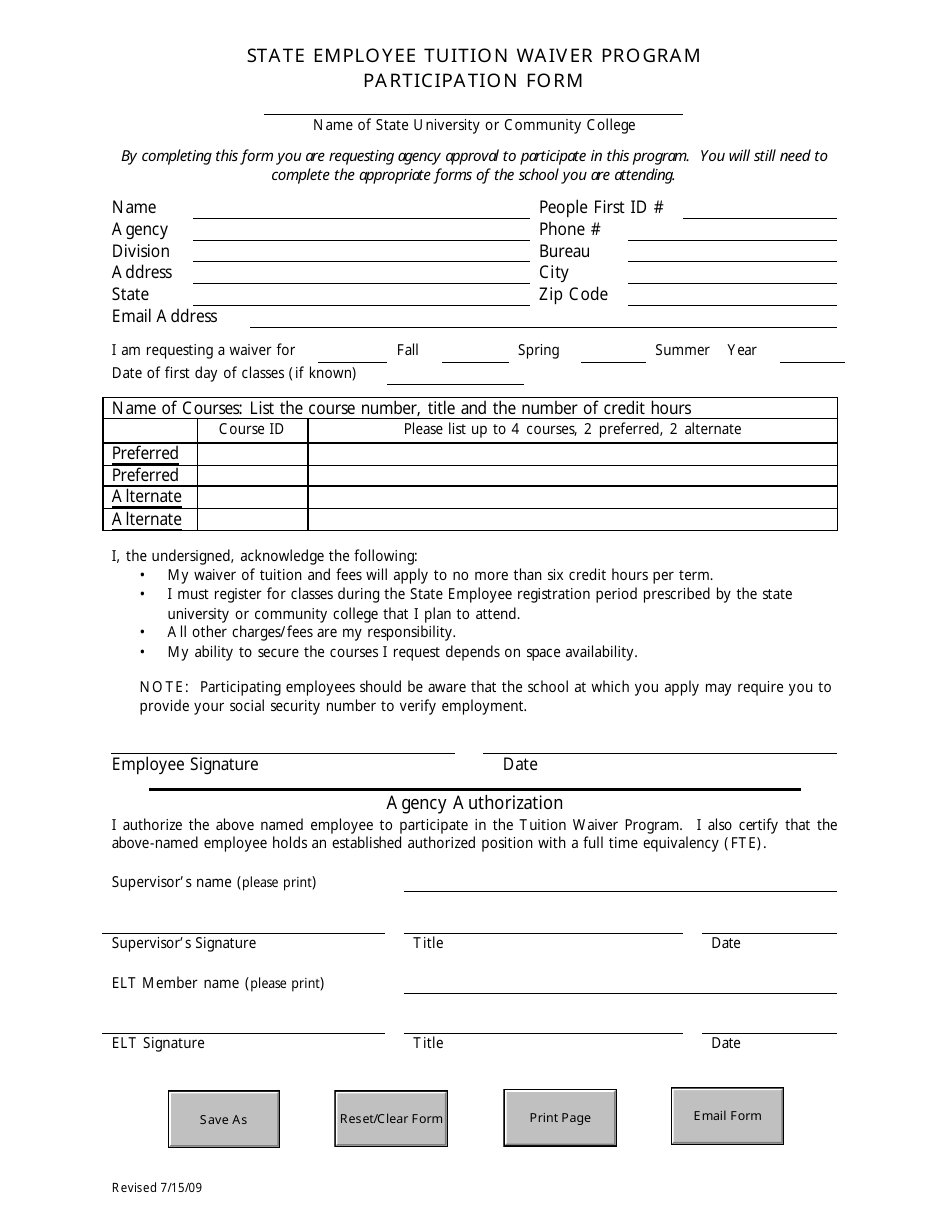

Florida State Employee Tuition Waiver Program Participation Form Download Fillable Pdf Templateroller

Free 7 Sample Yoga Waiver Forms In Ms Word Pdf

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Free 17 Sample Medical Waiver Forms In Pdf Word Excel

Free 8 Employee Waiver Forms In Pdf Ms Word

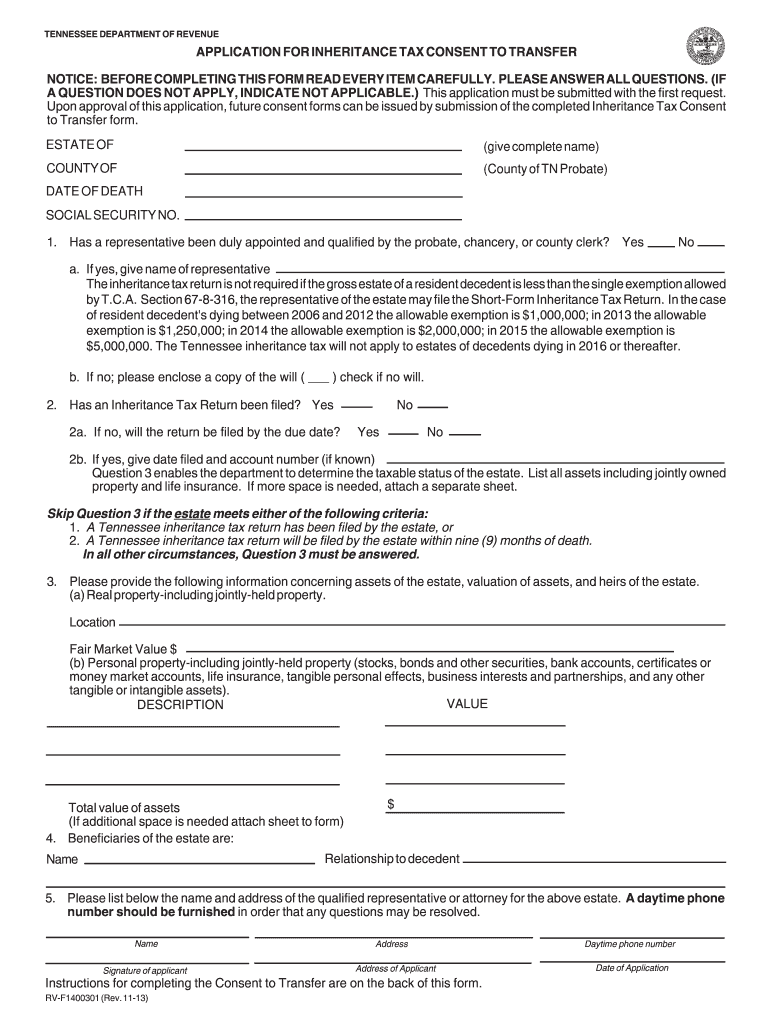

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Templates Tax Forms

Example Of Itemized Receipt Receipt Template Free Receipt Template Templates